The Banking, Financial Services & Insurance (BFSI) industry is the one that is most prone to uncertainties owing to its dependence on global trends, changing regulations and varying demographics of consumers.

Customer satisfaction is a very important parameter for any industry and even more so in the case of BFSI. Customers share their every detail with their banks/insurance provider which has a two-way implication;

firstly, these institutions have ever increased the opportunity to capitalize on this information.

Secondly, their customers feel their service providers have an obligation to keep them informed, and hence customer satisfaction is very feeble.

The leading institutions in this industry are leveraging data and analytics to redefine the playing field. They are enriching the customer’s information further by acquiring new information from the likes of telecom providers, retailers & social media. With this 360-degree view of their customers, they are able to drive revenue, mitigate risk and control cost.

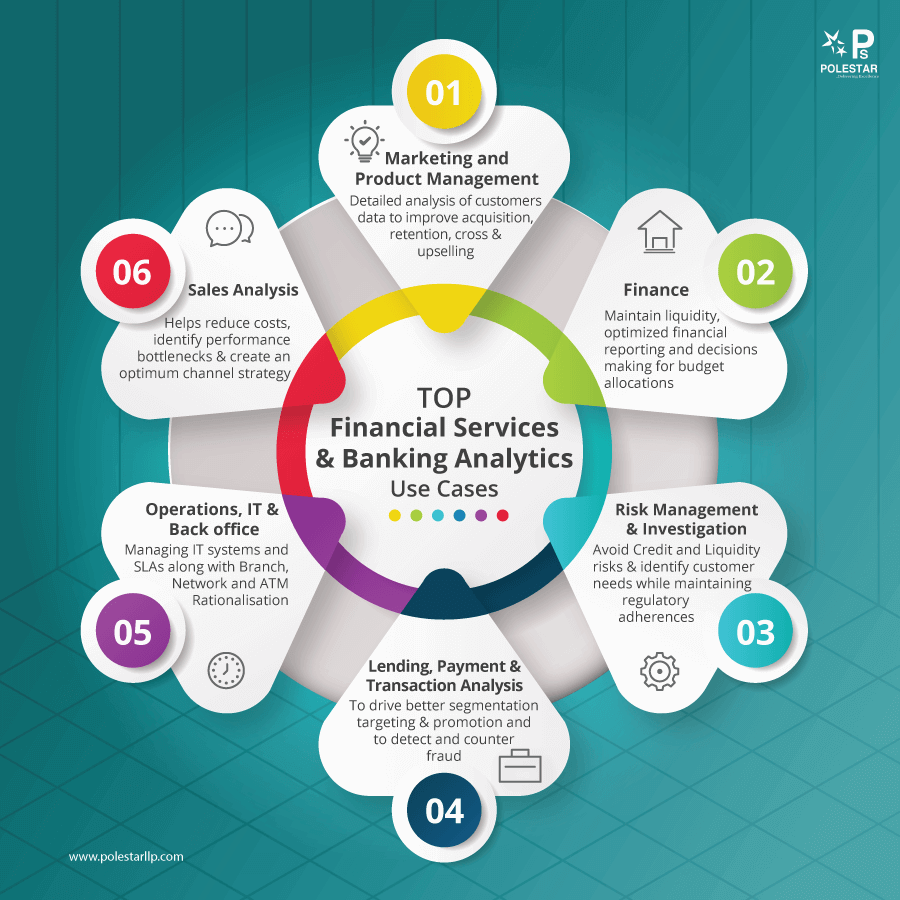

Sales Analysis:

Banks require a significant investment in the form of employees to cater to day-to-day operations. Deploying ways to enhance operational efficiency can significantly reduce the bottom line. An analytics system can provide the following benefits to a bank:

Sales & Revenue analysis helps banks reduce the ongoing costs by analyzing the operational processes. An understanding of sales patterns with respect to a customer can boost repeatability. Sales is a very strategic function and having Business Intelligence (BI) tool can help in setting benchmarks like the number of net new customers and identifying the profitable segment out of the existing customers.

Sales Performance Analysis provides a comprehensive report on workforce performance. It can provide insights to identify bottlenecks in the performance of any customer-facing employee such as sales personnel, account managers and tellers to discover ways for enhancing the customer experience. This analysis can be extended over to some new financial products or services to ascertain its profitability and make any strategic adjustment in line with the long-term goals of the institution.

Branch and Online channel Sales Analysis can help banks formulate an optimum channel strategy. Customers now interact with their banks via multiple channels. Their paths through them are extraordinarily complex: they often start in one channel, perform intermediate steps in others, and finish in yet another. Bankers can leverage this to deliver a truly seamless multichannel experience by gathering real-time data and using analytics to understand the buyer’s journey. It also helps them in keeping a view on their competition.

Banks can proactively harness their customers’ transaction data to suggest products or services pertinent to them. It results in a better conversion rate and customer satisfaction. Banks can use a BI tool to analyse the following set of customer-related information:

Banks can carry out Transaction Activity Analysis like deposits, withdrawals or payment information for existing customers. It helps bankers to understand customer’s spending patterns and push enticing offers on their credit/debit cards or some new financial product. This analysis can be put to use for providing timely spending alerts & reminders for any upcoming payments which improve the customer experience.

The banking transactions & queries asked by these customers can give insights into their Mortgage & Loan requirements. If they are offered the right benefits and approached at the opportune time, a significant uptick in the conversion could be the result.

By tracking customers’ transaction history and identifying the patterns, banks can detect fraudulent transactions and take measures to avoid such incidents. Leading banks are using analytics-aided techniques, such as digital credit assessment, advanced early-warning systems, next-generation stress testing, and credit-collection analytics to safeguard their customers against fraud.

The ever-increasing information about the customers presents an opportunity for the banks to reduce risk or take precautionary steps wherever possible. A BI system can give an early indication of these potential risks and help in mitigating them by:

Credit Risk & Exposure Analysis for customers can provide insights into customers who have some outstanding payments. Credit profiling of these customers to highlight their holdings and the customer behavioral information like outstanding payment, any payment defaults, earnings, etc. can be used to create a credit score of each customer.

Market & Portfolio Analysis is very crucial both to acquire new customers and retaining the existing ones. An analytics system can assist portfolio managers to maintain a steady return and suggest investment opportunities to customers based on their existing portfolios. Market analysis is again very important for creating a portfolio that thrives even in turbulent economic conditions.

Operational & Liquidity Risk: Every banking process can become faster and more effective. Among other things, banks can use advanced analytics to provide faster and more accurate responses to regulatory requests and give teams analytics-enhanced decision support

Banks deal with very stringent compliance and regulatory requirements. This has a lot to do with the scope of downside risk that they are subjected to. Know-your-customer (KYC) data Analysis is very important both for meeting the regulatory requirements as well as a way for risk mitigation. These BI tools help Anti-money Laundering (AML) Analysts to efficiently identify and monitor any suspicious account holder.

Solutions for Banking and Financial Services by Analytics Depot Solutions

Solutions for Banking and Financial Services by Analytics Depot Solutions

Like any other business, finance is the heart of any business. In the case of banks, it is even more impactful as apart from managing the day-to-day bank’s operations they also need to take care of their customer’s financial requirements. An analysis system can find the following use cases in a bank’s finances:

Banks need to maintain their own liquidity to efficiently manage their customers, historical Expense requirements analysis allows decision-makers to develop a clear set of critical success factors that turn short-term expense reduction into long-term, sustainable changes and ideal expense management.

BI systems can remove the hassles associated with Financial and management reporting. These systems can significantly reduce the effort required for financial reporting by automatically generating the crucial reports periodically. They also help in faster dissemination of information and keeping decision-maker apprised of the financial health of the bank.

P&L analysis by Line-of-Business (LOB) allows decision-makers to ascertain how a particular line-of-business is performing in terms of profitability. Basis this information, the concerned bank authorities could strategize their short-term and long-term goals.

Ever since the digitization of the bank processes IT and back-office support plays a major part in bank operations. Banks either have in-house teams or outsource these processes, in any case keeping a check on them is very crucial to maintain s superior end-consumer experience. BI tool can help banks in the following ways:

Analytics in banking and financial services can help in the efficient management of IT systems and Service Level Agreements (SLAs). These Systems provide the stakeholders with all the performance-related indicators of the workforce. This information helps decision-makers in evaluating the vendors’ effectiveness and avoid any unnecessary cost.

Branch & Network Optimisation is important for cost savings as well as better customer experience.

Using BI tools to predict the cash required at each of its ATMs across the country and combining this with route-optimization techniques, the banks can achieve ATM Rationalisation.

Interested in knowing more use cases for Insurance?

Learn how to harness the power of Data Analytics in Insurance industry to enable digital transformation to optimize operations

Sometimes it is required to approach an existing customer differently. Banks need to recommend new and optimized product portfolios for existing customers, and this information should reach them at the right time. Analysis of existing customers reveals the best strategies that have worked in the past and the same could be employed on net new customers. The BI systems can be used to

Deeper and more detailed profiles of customers, together with transactional and trading analytics, can improve the acquisition and retention of clients, as well as cross- and upselling.

Customer Portfolio and Segmentation analysis is another important use case of analytics systems. In order to sell to customers, they need to be segmented properly. Customer Segmentation for Financial Services companies looks like customers querying for a home loan or a car loan else it could be specific to a bank account such as a checking or a money market account. A relevant offer or call from the customer relationship manager can result in a successful conversion. Similarly, the audience list for launching any new offer can be toned down based on customers’ credit scoring.

Marketing campaign analysis provides an overview of the type channels working for a bank and optimize spending across these channels. Leading Banks use the information from credit-card transactional data (from both its own terminals and those of other banks) to develop offers that give customers incentive to make a regular purchase from one of the bank’s merchants.

Subscribe To Our Blogs

Sign up to get the latest news and developments in technology, business analytics, data science and Analytics Depot